The City of Peoria has a number of financial incentives to help business grow and create jobs. The state and local incentives are designed to increase investment and employment in Peoria. Contact the City of Peoria Economic Development Department to discuss which incentives are right for your business!

2020 City Business Development Programs - 20200101

2020 City Business Development Programs - 20200101

Click Here! To develop your on-line presence with Yelp! & TripAdvisor

Downloadable Files

![]() 2020 PUEZ APPLICATION - Form 200511

2020 PUEZ APPLICATION - Form 200511

Downloadable Files

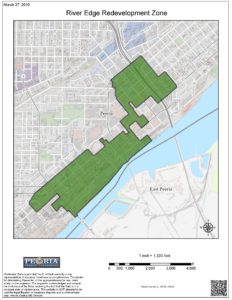

![]() 2020 RERZ APPLICATION - Form 200511

2020 RERZ APPLICATION - Form 200511

City of Peoria - TIFs (click on names below for Maps & Plans)

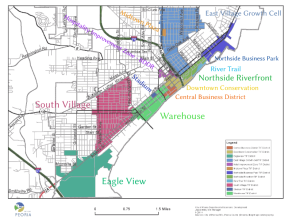

| # | TIF District | Expires | Final Payment |

| 1 | Central Business District | 2021 | 2022 |

| 2 | Downtown Conservation | 2035 | 2036 |

| 3 | Eagle View | 2029 | 2030 |

| 4 | East Village Growth Cell | 2033 | 2034 |

| 5 | Hospitality Improvement Zone | 2030 | 2031 |

| 6 | Midtown Plaza | 2021 | 2022 |

| 7 | |||

| 8 | |||

| 9 | River Trail | 2035 | 2036 |

| 10 | South Village | 2035 | 2036 |

| 11 | Stadium | 2022 | 2023 |

| 12 | Warehouse | 2029 | 2030 |

Downloadable File/s

![]() City of Peoria - TIF Program Guidelines - 190101

City of Peoria - TIF Program Guidelines - 190101

TIFs in Peoria have led to significant development, such as O’Brien Field, portions of the Riverfront redevelopment, and the Illinois Medical Center. It has also helped businesses like O’Brien Steel, PMP Fermentation and Plattner Orthopedics expand or locate in Peoria.

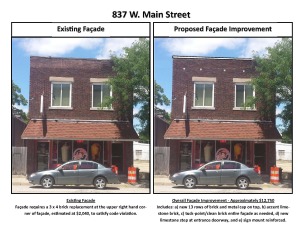

![]() South Village TIF Commercial Rehab Program - Guide & Application - 170901

South Village TIF Commercial Rehab Program - Guide & Application - 170901

RFP submissions are due by Wednesday, November 1, 2017, 4:00 p.m. to City of Peoria, City Manager’s Office, Economic Development, 419 Fulton St., Ste. 207, Peoria, IL 61602.For questions or additional information, please contact Leslie L. McKnight, PhD at 309-494-8651 or lmcknight@peoriagov.org.

Downloadable Files

Downloadable File

RLF funds may be used for a variety of purposes, from real estate to working capital loans. To learn more about financing your project go to our Creative Financing Webpage.

Downloadable File

Vendors/Contractors who wish to do business with the City of Peoria must first take steps to become aware of the materials, supplies, equipment, or services sought by the City. To start the process go the the Doing Business with the City Webpage. There you will learn how to find existing bid opportunities, position to receive future bids, and register your business as a vendor

IRB’s can be issued for amounts between $1.5M and $10M, and the interest rate is generally 2.5-3% below prime. These loans can be at fixed or variable rates and usually have terms of 20 years. Unlike many other state and locally-run programs, IRBs can fund 100% of costs. These costs can include purchase of land, buildings and new machinery. Applicants must secure the legal opinion of certified bond counsel.

In 2007, the City of Peoria has been allocated about $9.5M to use for industrial projects.(If this amount is not used for industrial projects, it is allocated for the Assist home buyers program.) Additionally, the state’s Illinois Finance Authority has authority over approximately $80M in separate funds. For more information on this tremendous benefit, please click here or call the Department of Economic Development at (309) 494-8600.

Several tools were developed in early 2017 to encourage the startup and expansion of Minority-owned Business Enterprises (MBEs). Many of these programs can be layered together with other programs to provide business financing. A description of each is provided below.

Minority-Business Implementation Grant (M-BIG) Program: The M-BIG program awarded 6 cash prizes of $2,500 to startup and existing MBEs that: a) created new market opportunities, b) capturde new market share, or c) met untapped or emerging market demand.

Minority Business Grant Opportunities Research: The City commissioned a study to determine what grant resources are available for MBEs. To learn more about grant opportunities for your business, please review the MBE - Grant Opportunity Research and click through the links resources in the attached document.

Micro Loan Opportunities: The City conducted a review of micro-lenders interested in providing small business loans, less than $15,0000, to help with startups and small project financing. Please contact the micro-lender listed in the attached based on your business financing needs.

Downloadable Files

Here are a few websites, documents, and contact information to help employers find training resources:

State Resources

https://www.illinois.gov/dceo/WorkforceDevelopment/ProgramsAndResources/Pages/default.aspx

Employers seeking Training for Employees should go to:

https://www.illinoisworknet.com/userguides?tagIDs=269

A good start is to contact :

Career Link at http://www.careerlink16.com/professionalTraining.asp

David Vaughn 309 999-4591 or dvaughn@careerlink16.com

Downloadable Files

![]() IL Work Net - Training Employees_Final - 170612

IL Work Net - Training Employees_Final - 170612

The City works closely with other partners that aid in the growth of small business. Below are links to the various partners that you can click on for more details on what services they provide:

Peoria Downtown Development Corporation

CEO Council

Bradley University’s Turner Center for Entrepreneurship

Illinois Small Business Development Center

SBDC International Trade

Peoria Area Chamber of Commerce

Procurement and Technical Assistance Center (PTAC)

Peoria County Economic Development

S.C.O.R.E – Counselors to America’s Small Business

Illinois Department of Employment Security

Peoria County G.A.P. Loan: Secondary financing, not to exceed 40% of total financing package. There must be at least 10% equity participation from business. County will lend $10,000 per job created or retained, not to exceed $150,000. Fixed interest rate 3% below prime (not lower than 3%). Term will be one year for each $15,000 loaned (7 years maximum for loans for inventory and working capital).

Illinois Finance Authority Participation Loan: IFA will work with prime lender to purchase up to 50% ($1M max) of a loan for purchase of land or buildings, construction or renovation of buildings, and acquisition of machinery and equipment. Interest rate is 2% below the lender’s rate, leading to a blended rate (lender may take up to 1% as servicing fee). 10 year maximum term (if lender term is longer, balloon payment required after 10 years).

Illinois Department of Commerce and Economic Opportunity (DCEO) Enterprise Zone Participation Loan: Works much like the IFA’s Participation Loan, but is limited to businesses expanding or locating in an Enterprise Zone. Funds can be used for purchase and installation of machinery and equipment, working capital, purchase of land, construction or renovation of buildings. Cannot be used for debt refinancing or contingency. For DCEO’s portion of the loan, the interest rate on variable-rate loans is 2% below indexed rate. Fixed and adjustable rates are similar to US Treasury notes, plus 0-1%. Borrower cannot employ more than 500 FTEs.

DCEO’s EDGE Tax Credits: The Economic Development For a Growing Economy Tax Credit Program (EDGE) is designed to offer a special tax incentive to encourage companies to locate or expand operations in Illinois. The program can provide tax credits to qualifying companies, equal to the amount of state income taxes withheld from the salaries of employees in the newly created jobs. The non-refundable credits can be used against corporate income taxes to be paid over a period not to exceed 10 years.

DCEO’s Manufacturing Modernization Loan: Secondary financing of between $10K and $750K for manufacturers who are retooling, upgrading machinery, or expanding. Must constitute 25% or less of total financing package. Sub-prime rates, maximum term of 10 years.

DCEO Revolving Line of Credit: Allows businesses to borrow the amount of money needed to meet the demand and to repay the loan from the sales revenues. Line of credit established for between $10K and $750K, but not more that 25% of total project. Attractive interest rates, but all review and terms set by lead lender. Must not employ more than 500 FTEs. Three year maximum term.

Illinois State Treasurer’s Economic Program: The Treasurer will deposit up to $25K into the business’ bank at below market rates for each full-time employee created or retained. That bank, in turn, can lend those funds to the business at below prevailing rates for a term of between 1 and 5 years.

Illinois State Treasurer’s Economic Recovery Loan Program: Similar to the STEP program directly above, but the limit to be deposited is up to $50K per job created or retained.

Federal Historically Underutilized Business (HUB) Zone: Businesses may want to explore HUB Zone certification to better position themselves as contractors on government funded projects.

![]() HUB ZONE Historically Underutilized Business Zone - 170323

HUB ZONE Historically Underutilized Business Zone - 170323

US Small Business Administration (SBA) 504 Loan: Provides businesses with long-term, fixed-rate financing for major fixed assets, such as land, building,and machinery and equipment, not to exceed 40% of total financing package. Requires 10% equity participation by business. For most businesses, the loan is $65,000 per job created, up to $1.5M. For “small manufacturers”, the loan can be $100,000 per job created, up to $4M. Interest rate tied to 5- and 10-year US Treasury issues. Term is 10 or 20 years.

SBA 7(a) Loan: Loan guaranty for prime lender. All financing is handled through the lender, with partial guaranty by SBA in case of failure to pay. Applicants must meet certain qualification set out by SBA. Maximum loan is $2M (75% guaranty). Maximum of 25 year term for real estate and equipment, 7 years for working capital. Interest rates may be fixed or variable and may not exceed the prime rate by a certain number of points (depends on size and term).

For more information on any of these programs please contact:

City of Peoria

Economic Development Office

419 Fulton St. Ste 207

Peoria, IL 61602

Phone: (309) 494-8640

Fax: (309) 494-8650